Blank-Cheque Companies . spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. these blank cheque companies are essentially a shell company formed by investors to raise money through an ipo. churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund.

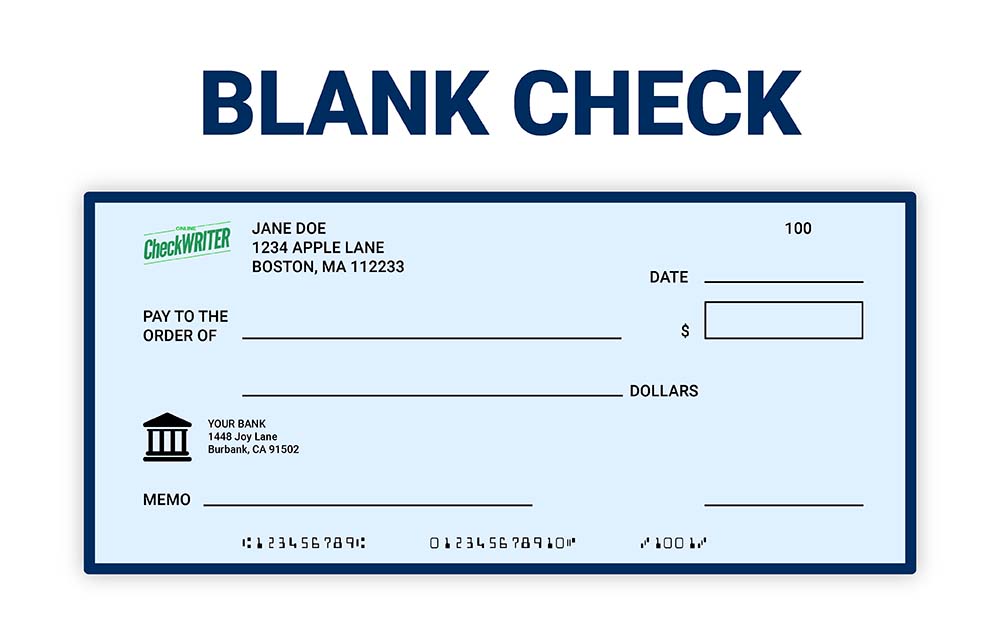

from onlinecheckwriter.com

churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund. these blank cheque companies are essentially a shell company formed by investors to raise money through an ipo. spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill.

What Is a Blank Check?

Blank-Cheque Companies churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. these blank cheque companies are essentially a shell company formed by investors to raise money through an ipo. spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund.

From pray.gelorailmu.com

Blank Cheque Template Uk Blank-Cheque Companies relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund. these blank cheque companies are essentially a shell company formed. Blank-Cheque Companies.

From pngtree.com

Blank Bank Check Template Download on Pngtree Blank-Cheque Companies spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. a spac is a type of shell company that raises funds through an ipo that. Blank-Cheque Companies.

From slidechef.net

Free Blank Cheque Template PowerPoint & Google Slides Blank-Cheque Companies relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. these blank cheque companies are essentially a shell company formed by investors to raise money through an ipo. churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest. Blank-Cheque Companies.

From uroomsurf.com

10+ Printable Blank Business Check in psd room Blank-Cheque Companies a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. these blank cheque companies are essentially a shell company formed by investors to raise money. Blank-Cheque Companies.

From www.etsy.com

Blank Cheque Blank Check Template Blank Checks Editable Cheque Template Blank-Cheque Companies a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. these blank cheque companies are essentially a shell company formed by investors to raise money. Blank-Cheque Companies.

From www.youtube.com

Blankcheque companies Tracking the meteoric rise of SPACs YouTube Blank-Cheque Companies churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund. a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. relying on the reputation of the founder, spacs are often. Blank-Cheque Companies.

From ar.inspiredpencil.com

Customizable Blank Check Template Blank-Cheque Companies spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. these blank cheque companies are essentially a shell company formed by investors to raise money. Blank-Cheque Companies.

From etna.com.pe

Art & Collectibles Editable Blank Cheque Printable Check Bank Cheque Blank-Cheque Companies relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund. these blank cheque companies are essentially a shell company formed. Blank-Cheque Companies.

From depositphotos.com

Blank bank cheque template. Check from checkbook Stock Vector Image by Blank-Cheque Companies churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. these blank cheque companies are essentially a shell company formed. Blank-Cheque Companies.

From www.britbuyer.co.uk

How To Write a Cheque in the UK [With Examples] Brit Buyer Blank-Cheque Companies churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund. spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. a spac is a type of shell company that raises. Blank-Cheque Companies.

From www.dreamstime.com

Blank Cheque Royalty Free Stock Photo Image 15179595 Blank-Cheque Companies relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. spacs, colloquially known as blank cheque companies, raise money in an initial public offering before. Blank-Cheque Companies.

From www.alamy.com

Blank bank cheque template in shades of green Stock Photo Alamy Blank-Cheque Companies a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. these blank cheque companies are essentially a shell company formed by investors to raise money. Blank-Cheque Companies.

From www.vrogue.co

Large Blank Cheque Template Sample Template vrogue.co Blank-Cheque Companies relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. these blank cheque companies are essentially a shell company formed by investors to raise money through an ipo. a spac is a type of shell company that raises funds through an ipo that can then be. Blank-Cheque Companies.

From www.xfanzexpo.com

Large Blank Barclays Bank Cheque For Charity / Presentation throughout Blank-Cheque Companies these blank cheque companies are essentially a shell company formed by investors to raise money through an ipo. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest. Blank-Cheque Companies.

From www.linkedin.com

SPAC “THE BLANK CHEQUE COMPANY” Blank-Cheque Companies these blank cheque companies are essentially a shell company formed by investors to raise money through an ipo. spacs, colloquially known as blank cheque companies, raise money in an initial public offering before searching for a company to acquire. churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest. Blank-Cheque Companies.

From epaper.dawn.com

DawnePaper Oct 31, 2022 `Blank cheque` companies Blank-Cheque Companies churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one of the largest deals executed by a “blank cheque” buyout fund. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. a spac is a type of shell company that raises. Blank-Cheque Companies.

From cashier.mijndomein.nl

Blank Cheque Template Blank-Cheque Companies relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. these blank cheque companies are essentially a shell company formed by investors to raise money. Blank-Cheque Companies.

From www.vrogue.co

Blank Cheque Template Illustrations Creative Market vrogue.co Blank-Cheque Companies a spac is a type of shell company that raises funds through an ipo that can then be used for acquisitions. relying on the reputation of the founder, spacs are often described as ‘blank cheque’ companies, with business leaders such as bill. churchill capital corp iii, which raised $1.1bn in february, will merge with multiplan in one. Blank-Cheque Companies.